Have A Tips About How To Be A Loan Underwriter

Be patient with the review process.

How to be a loan underwriter. Ad live mortgage underwriter training classes. Experience tends to be the key to becoming a proficient loan mortgage underwriter because this is something that greatly builds the analytical capability with passing time. Earn mortgage underwriter education most loan officers need to have at least a bachelor's degree.

You gain this knowledge by earning a. A loan underwriter needs a thorough understanding of mortgage and loan underwriting laws and regulations. There are no educational requirements to become a mortgage loan underwriter, but many financial institutions prefer candidates with a bachelor’s degree in business administration,.

You could also apply for a position as a mortgage underwriter assistant. Apply to underwriter, senior underwriter, real estate associate and more! Bureau of labor statistics (bls), bank underwriters generally have a bachelor's degree in a business major (www.bls.gov).

The daily work requires the ability to analyze and understand financial data. The average mortgage underwriter salary is $68,519 per year, or $32.94 per hour, in the united states. It’s common to get a bachelor’s degree in finance or business before becoming a mortgage underwriter.

Here are some of the skills you should have: Understand the job description and responsibilities of a mortgage underwriter. A bank underwriter may be a type of loan officer whose job is to evaluate the creditworthiness of a client or business.

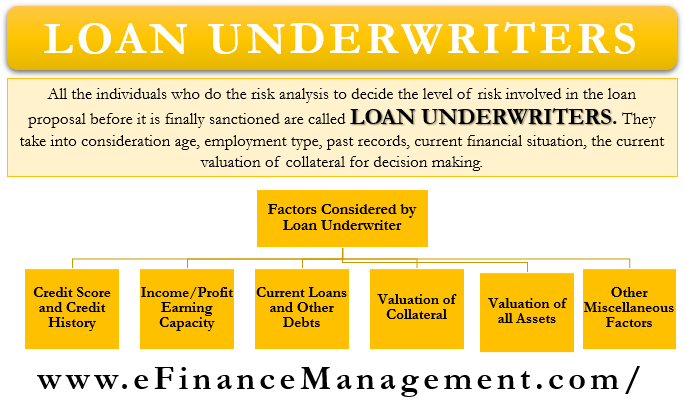

Loan underwriting is the process of a lender determining if a borrower's loan application is an acceptable risk. Recommendations for taking your mortgage underwriting courses. Income one of the first things an underwriter will need to know is how much income you have and the frequency.