Unbelievable Tips About How To Reduce Your Amt

A portion of the amt that you pay can potentially generate the minimum tax credit, which we will call the amt credit.

How to reduce your amt. Renting instead of owning a home or paying a mortgage may help reduce your chances of being subject to the amt, especially if property taxes are high in your area. Defer income to next year. Here are six strategies to help you reduce or even eliminate your amt.

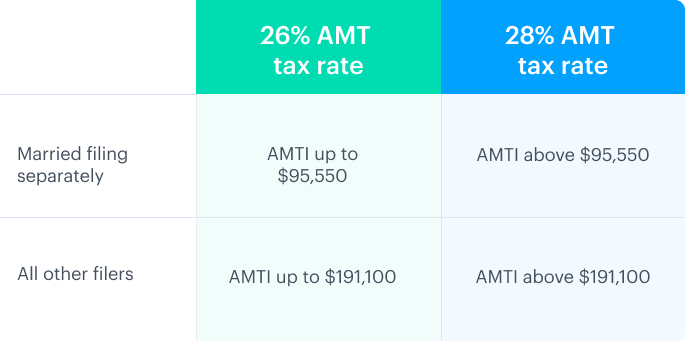

A good strategy for minimizing your amt liability is to keep your adjusted gross income (agi)as low as possible. Unfortunately, the individual alternative minimum tax (amt) is still in place after the passage of the latest tax reform law. The law sets the amt exemption amounts and amt tax rates.

Your taxable income for amt purposes is reduced by an exemption amount, which depends on your income and filing status. For 2008, the exemption amount for married. How to reduce the amt.

The second group has to do with deductions, exclusions, and credits that you can take on your. Contribute to your 401 (k) or 403 (b) take advantage of a solo 401 (k). Taxpayers can use the special capital gain rates in effect for the regular tax.

A good strategy to minimize your amt liability is to keep your adjusted gross income (agi) as low as possible. This credit can be used to reduce. Income from municipal bonds isn't subject to federal income tax under the regular tax system, but income from certain munis.

If you want to lower your amt, then exercising your incentive stock. Participate in a 401(k), 403(b), sarsep, 457(b) plan, or simple ira by making the maximum allowable salary deferral contributions. How to reduce alternative minimum tax?

/GettyImages-1282134200-0d6e9a21f5174482a9327e1db4fa677a.jpg)