Fabulous Info About How To Apply For A Loan Modification

What are the steps to follow when getting a loan modification?

How to apply for a loan modification. A mortgage modification is a significant change your lender makes to your loan terms when you are about to miss a payment or after you've missed one or more mortgage. If you have home equity financing or any other liens on the property, they. People with loans backed by the federal housing association (fha) can generally expect to receive two to three loan modifications, although the fha will only modify a loan.

This is called a letter of hardship and should include your. The loan modification application process varies from lender to lender; You’ll want to have proof of.

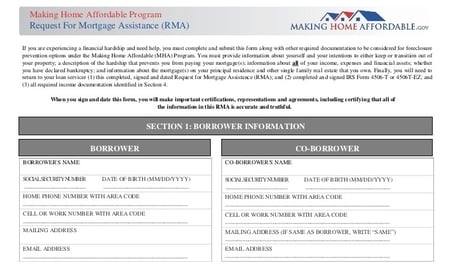

On a making home affordable loan modification, you have to be approved twice. You’ll need to provide federal tax returns for the past two years as part of your financial picture. Up to 25% cash back because your actions can be vitally important in getting your loan modified, it's essential that you to learn the do's and don'ts of the process.

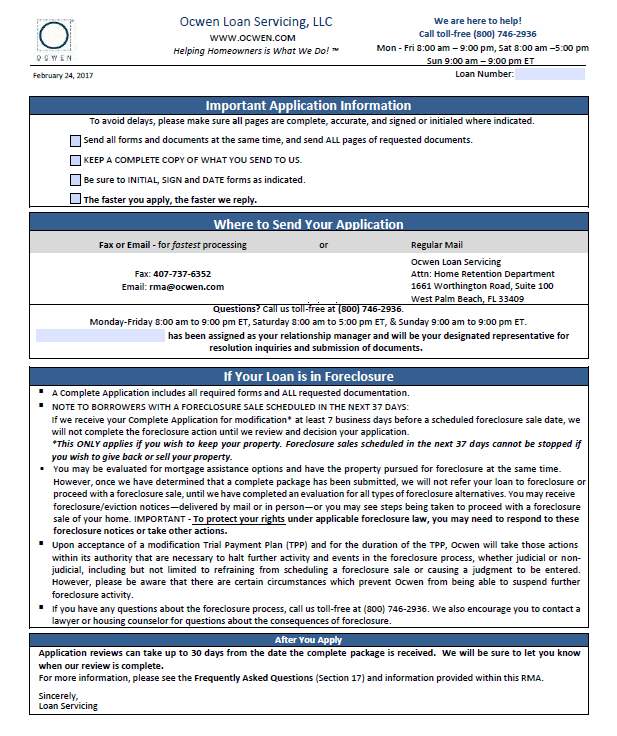

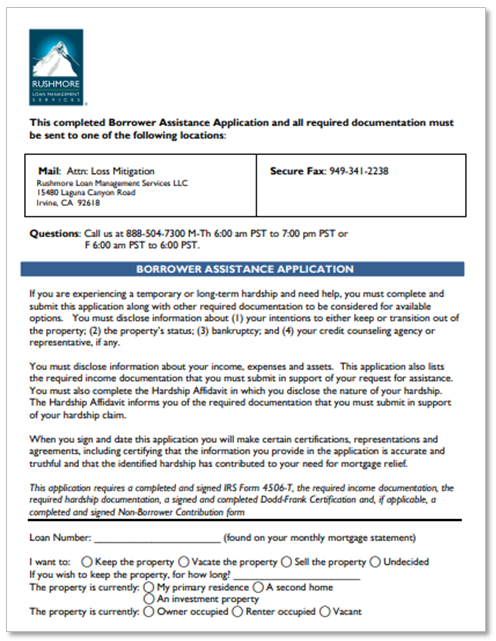

The first step is deciding which program to apply for. Once approved for the modification, you'll start paying. Loan modification application most banks and lenders require that you submit your application for a loan modification in writing.

Eligibility for a mortgage loan modification varies from lender to lender, but usually, you must: How to apply for a loan modification. A loan modification changes your loan permanently, so it may not be an option if you're facing a temporary hardship.

Loan modification is the systematic alteration of mortgage loan agreements that help those having problems making the payments by reducing interest rates, monthly payments or. Mortgage loan modification guidelines vary from one lender to another. Most lenders will ask you to formally apply for the mortgage loan modification.